Or go to our Shopify Theme Detector directly

Do you Need Insurance to Sell on Shopify?

Last modified: December 11, 2023

In short, your business does not need insurance if you’re selling products on Shopify. They won’t penalize you for not having insurance, and will not ask you for proof of any policy before you launch your website. However, there are numerous reasons why you might want to consider protecting yourself with insurance when you want to set up a Shopify store.

| # | Name | Image | |

|---|---|---|---|

| 1 |

|

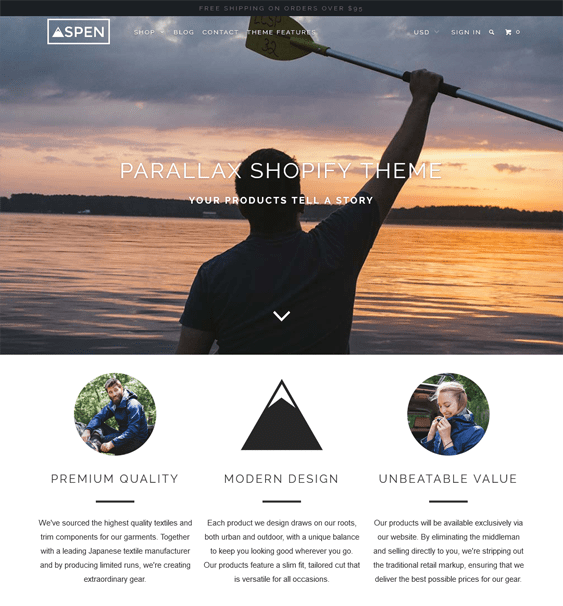

Aspen-SEO Optimized Theme

|

|

| 2 |

|

Citrus-One Page Theme

|

|

| 3 |

|

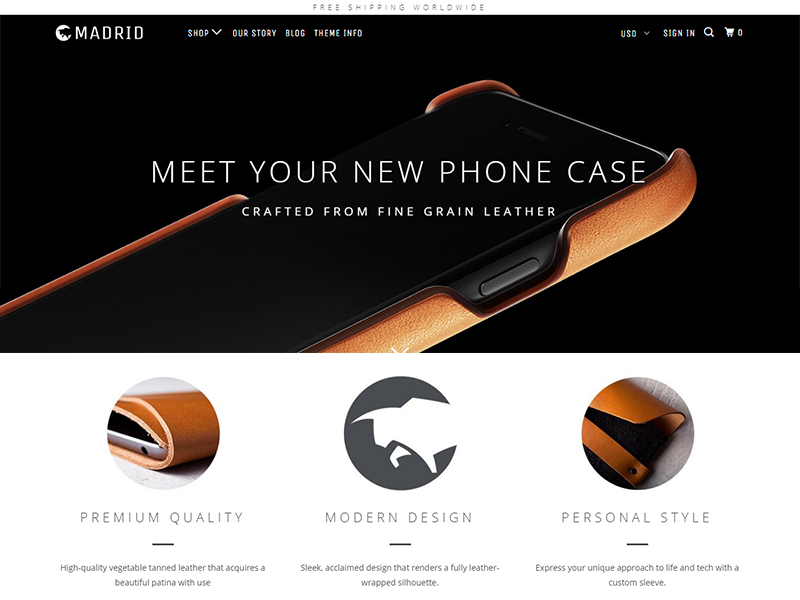

Madrid-Search Engine Optimized

|

|

| 4 |

|

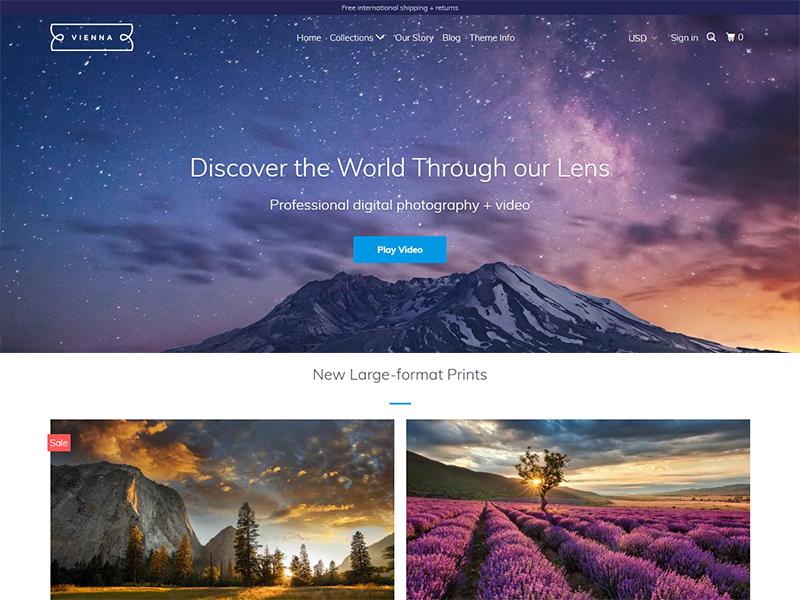

Vienna-Mobile Friendly Design

|

|

| 5 |

|

Kids Life-Shopify Kids' Website Theme

|

|

| 6 |

|

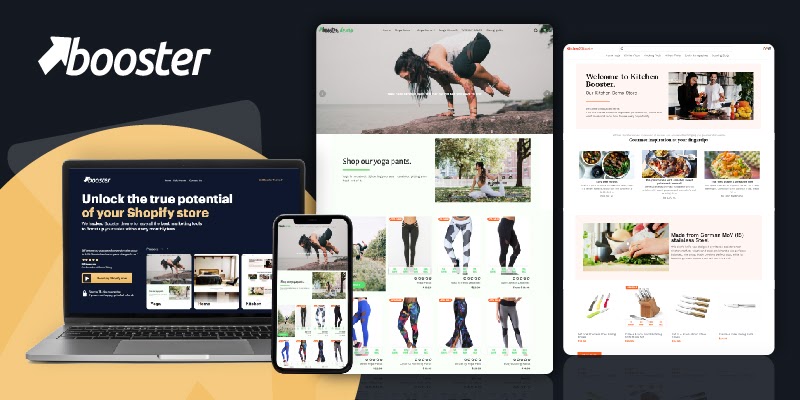

Booster

|

|

| 7 |

|

Wood Furniture Decoration-A Theme for Furniture Ecommerce

|

|

| 8 |

|

Interior-Furniture/Interior Theme

|

|

| 9 |

|

Los Angeles-Mobile Friendly Theme

|

|

| 10 |

|

Anormy-Multipurpose Theme

|

|

| 11 |

|

High Fashion-Clothing Theme

|

|

| 12 |

|

Uptown Jeans-Responsive Theme

|

|

| 13 |

|

Regolith-Horizontal Portfolio Theme

|

|

| 14 |

|

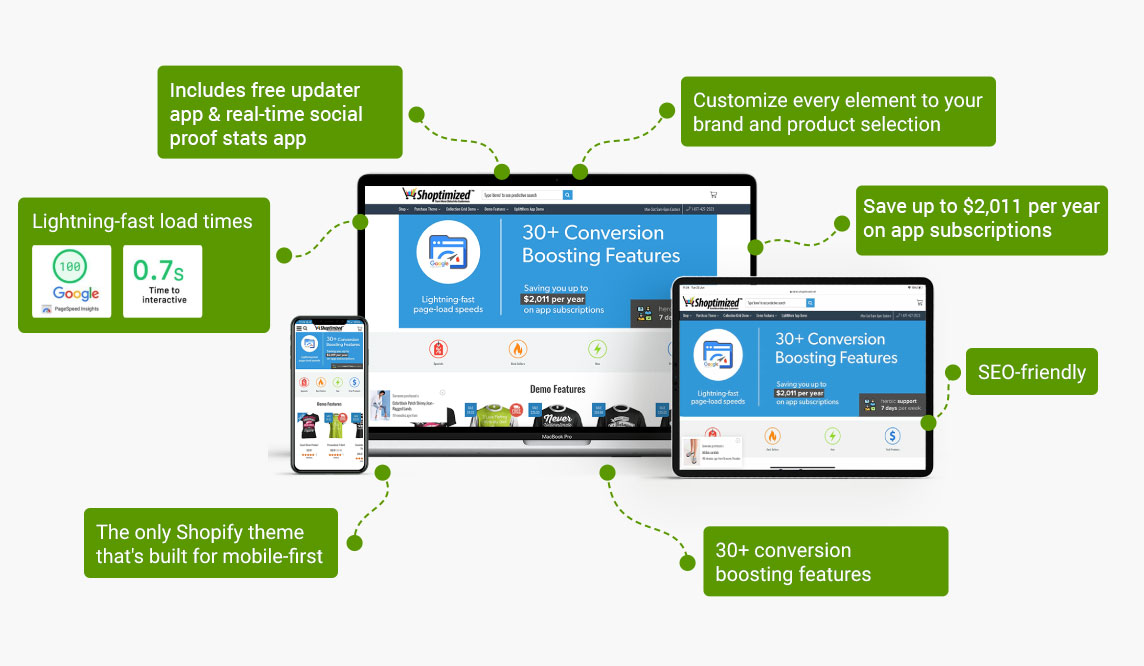

Shoptimized

|

|

|

Show More

|

|||

The Advantages of Insurance for Shopify

There are many reasons why getting business insurance is a good idea for your store. For one, if your premises are broken into and stock is stolen, you have a backup that allows you to claim for the value of that stock and repairs to your premises.

You can also have claims made against you as a business if someone thinks you’ve sold them a defective product that has then injured them. Even something as simple as a cut can result in your company being sued by a claimant.

It is important to note that customers probably expect you to have an insurance policy in place to cover for this. If you don’t, and the claim is successful, then you can be sure that you could end up losing out significantly from it.

If you’re not an incorporated business, then you can place your personal assets at risk as well as your business assets.

Another factor to consider is that insurance is there to help you. For example, if there is a hacking incident at your business and customer data is stolen, insurance can help you recover.

Likewise, if there is a fire, insurance can help you fix your premises and replace lost stock/contents.

What to Think About When it Comes to Insurance

Insurance is an important part of running a business. Most businesses probably don’t even need to use insurance, but the reassurance of it there is good.

Customers also expect to see that you’ve got insurance. And some clients will demand that you have insurance to do business with you.

So be sure that you are looking at buying insurance for your brand. There are different types of insurance you might need.

For instance, you could get digital protection, cybercrime protection, professional indemnity and public liability insurance.

Be sure to speak to a broker before buying insurance, as they will know better what you need, and they’re legally obliged to offer you the best advice available.

Understanding Ecommerce Insurance Needs

Why Insurance Matters for Shopify Stores

Insurance is crucial for Shopify store owners to mitigate risks associated with online retail. While Shopify provides a robust platform, it doesn’t shield you from legal liabilities or unforeseen events.

Insurance can cover bodily injury claims, product liability, and even cyber threats, ensuring your business’s resilience.

Types of Insurance for Online Retailers

Several insurance types are essential for ecommerce businesses. General liability insurance covers injuries or damages linked to your business operations.

Product liability insurance is vital for product-related injuries or defects. Additionally, cyber liability insurance protects against data breaches and cyberattacks, crucial in the digital retail space.

Choosing the Right Insurance Policy

Selecting the appropriate insurance policy involves assessing your business risks. Factors like product type, business size, and operational risks determine the coverage you need.

Start with general liability and product liability insurance, and consider adding cyber liability as your online presence grows.

Securing Your Shopify Business

Steps to Acquire Ecommerce Insurance

To obtain ecommerce insurance, begin by evaluating your business risks and needs. Consider factors like product type, inventory storage, and employee count. Then, explore insurance options through brokers, online marketplaces, or direct contact with providers.

Understanding Policy Details

Once you choose an insurance provider, familiarize yourself with the policy details. Understand coverage limits, terms, and how to file claims. Regularly review and update your policy to align with your evolving business needs.

Importance of a Certificate of Insurance (COI)

A Certificate of Insurance (COI) is a crucial document proving your business is insured. It details coverage amounts and policy terms. While not mandatory for Shopify stores, a COI provides assurance and protection against legal and financial risks.

Conclusion: Do you Need Insurance to Sell on Shopify?

Shopify won’t stop you from selling without insurance on their platform. However, that doesn’t mean that you shouldn’t have insurance. It will protect you from claims made against your business and prevent financial loss should a claim made against you be enforced.

-

What role does insurance play in building customer trust in a Shopify store?

Insurance enhances customer trust by demonstrating a store’s commitment to safety and reliability. It assures customers that the store is prepared to handle any issues, from product defects to data security, enhancing the overall credibility of the business.

-

Are there specific insurance requirements for Shopify stores selling internationally?

For Shopify stores selling internationally, it’s important to have insurance that covers global shipping and product liability across different jurisdictions. This ensures protection against legal and logistical challenges in international e-commerce.

-

How does insurance for a Shopify store differ from traditional retail insurance?

Insurance for Shopify stores is tailored to the unique risks of online retail, such as cyber threats and global shipping. Unlike traditional retail insurance, it often includes specific coverage for digital data breaches and international logistics.

PageFly Landing Page Builder

PageFly Landing Page Builder  Shopify

Shopify  SEMrush

SEMrush  Website Maintenance

Website Maintenance  UpPromote

UpPromote