Or go to our Shopify Theme Detector directly

What Does Passive Income Mean?

Last modified: March 13, 2024

If you’re new to online business and would like to generate a lot of great income, then you might have heard of passive income and would like to know more. So, what does passive income mean? And what can you do to have more passive income in your business?

| # | Name | Image | |

|---|---|---|---|

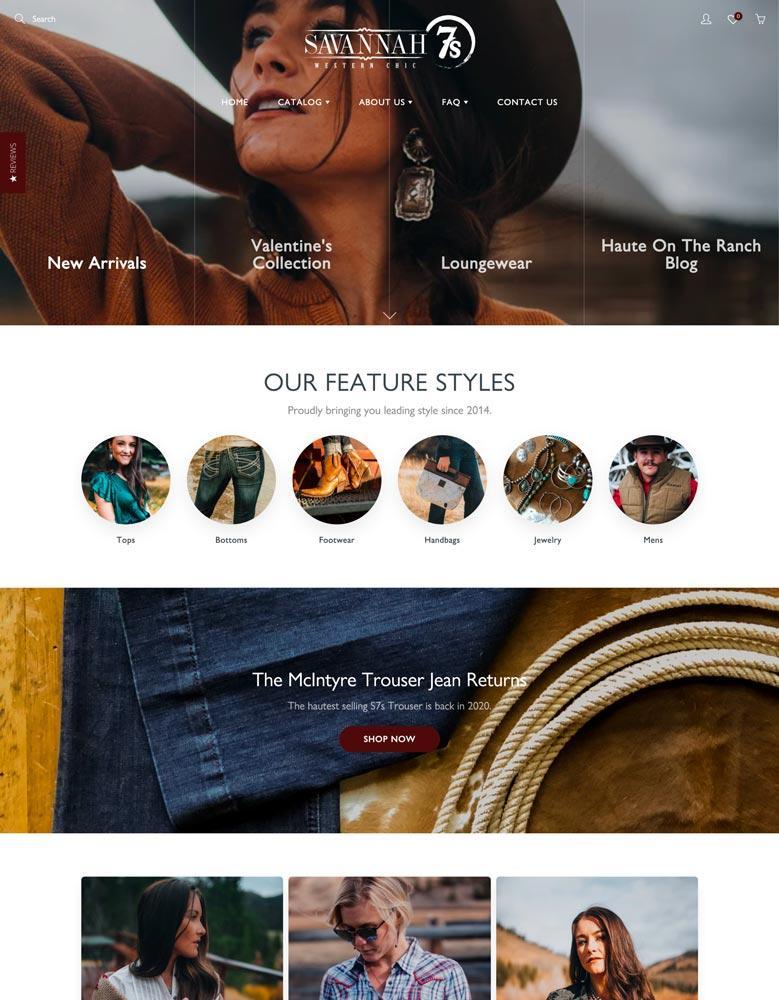

| 1 |

|

Galleria

|

|

| 2 |

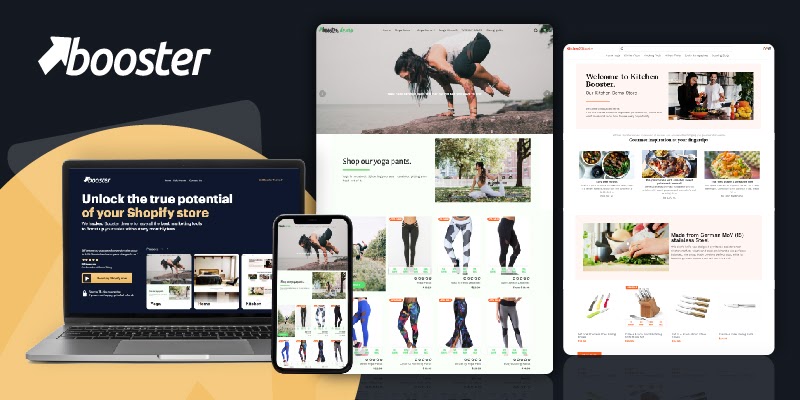

|

Booster

|

|

| 3 |

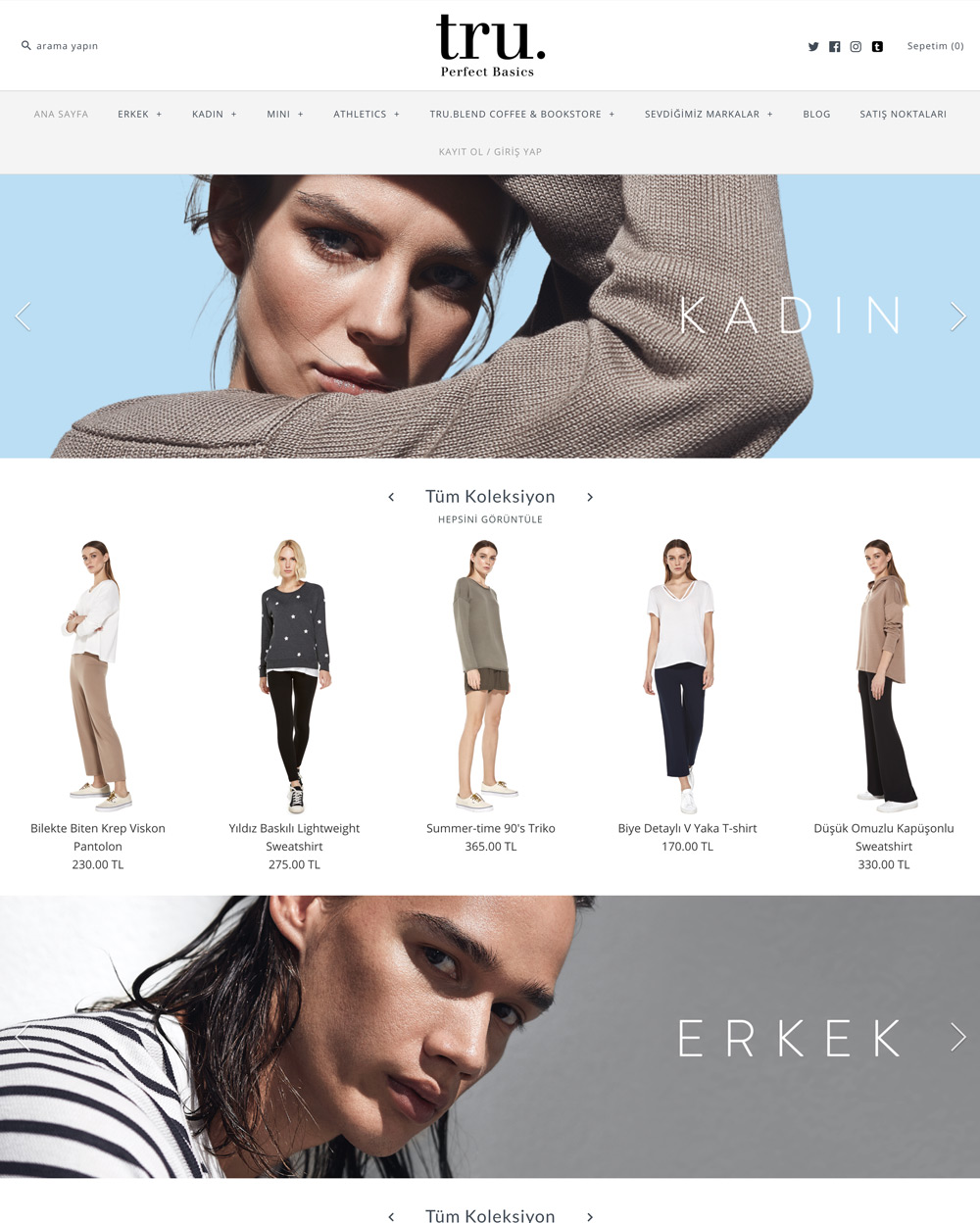

|

Symmetry

|

|

| 4 |

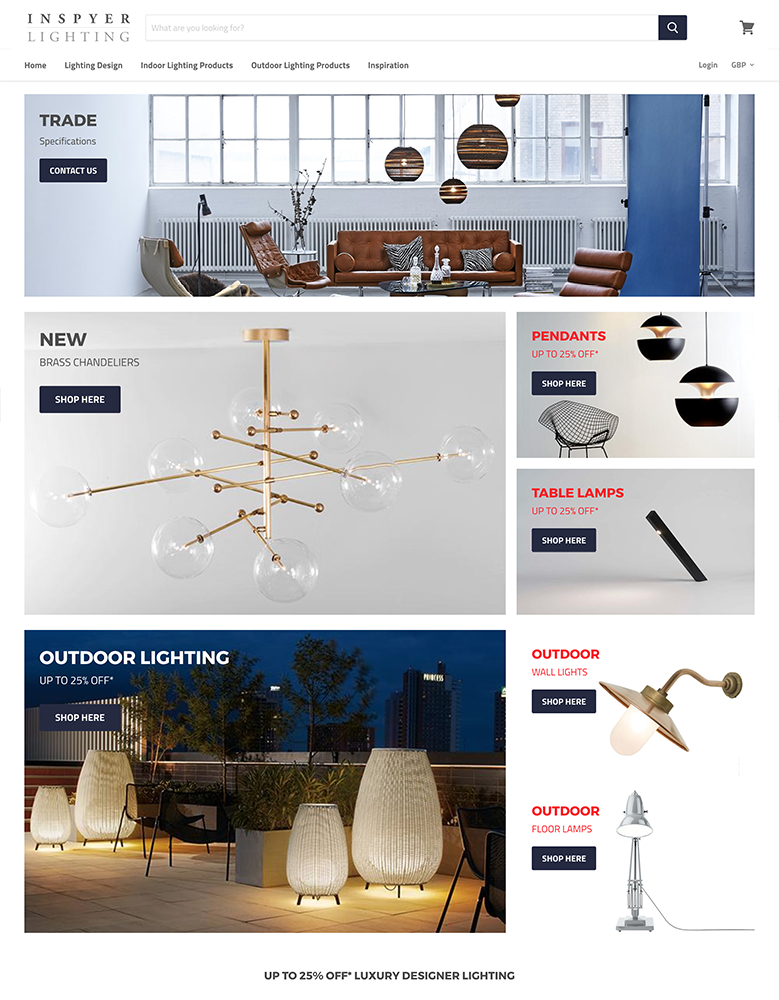

|

Empire

|

|

| 5 |

|

Avenue

|

|

| 6 |

|

Context

|

|

| 7 |

|

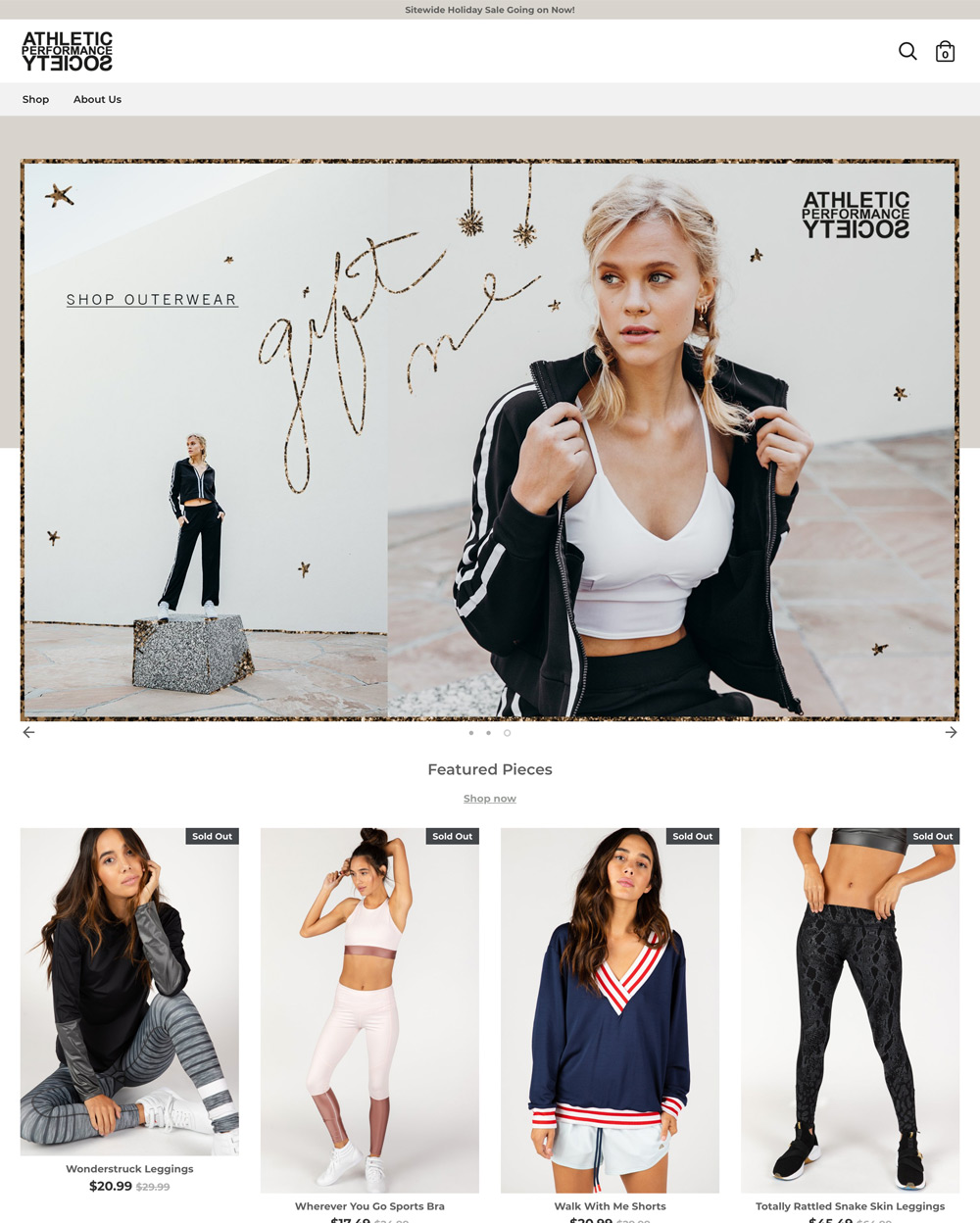

Boost

|

|

| 8 |

|

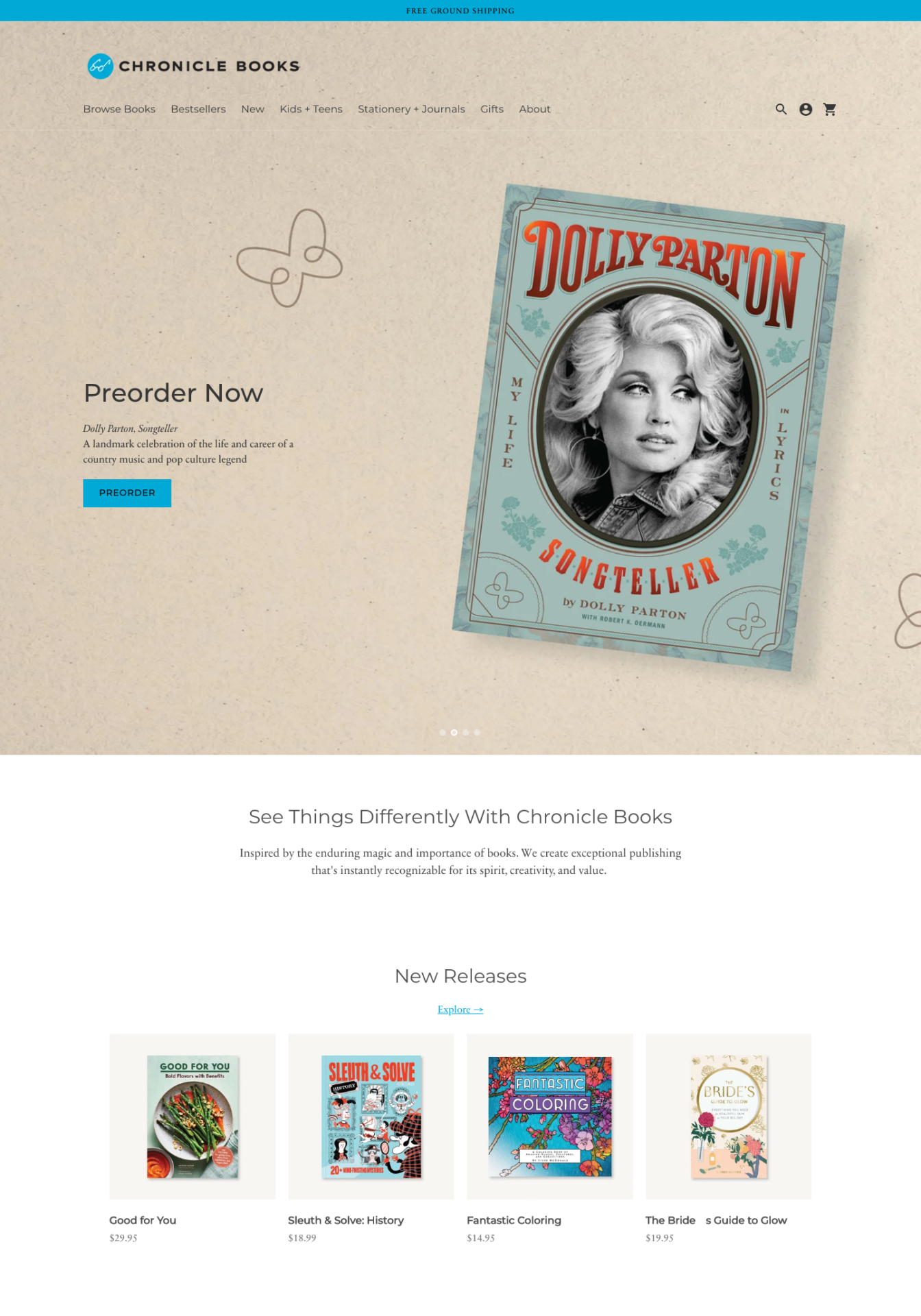

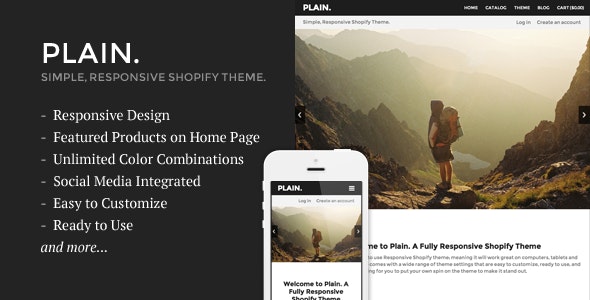

Plain

|

|

| 9 |

|

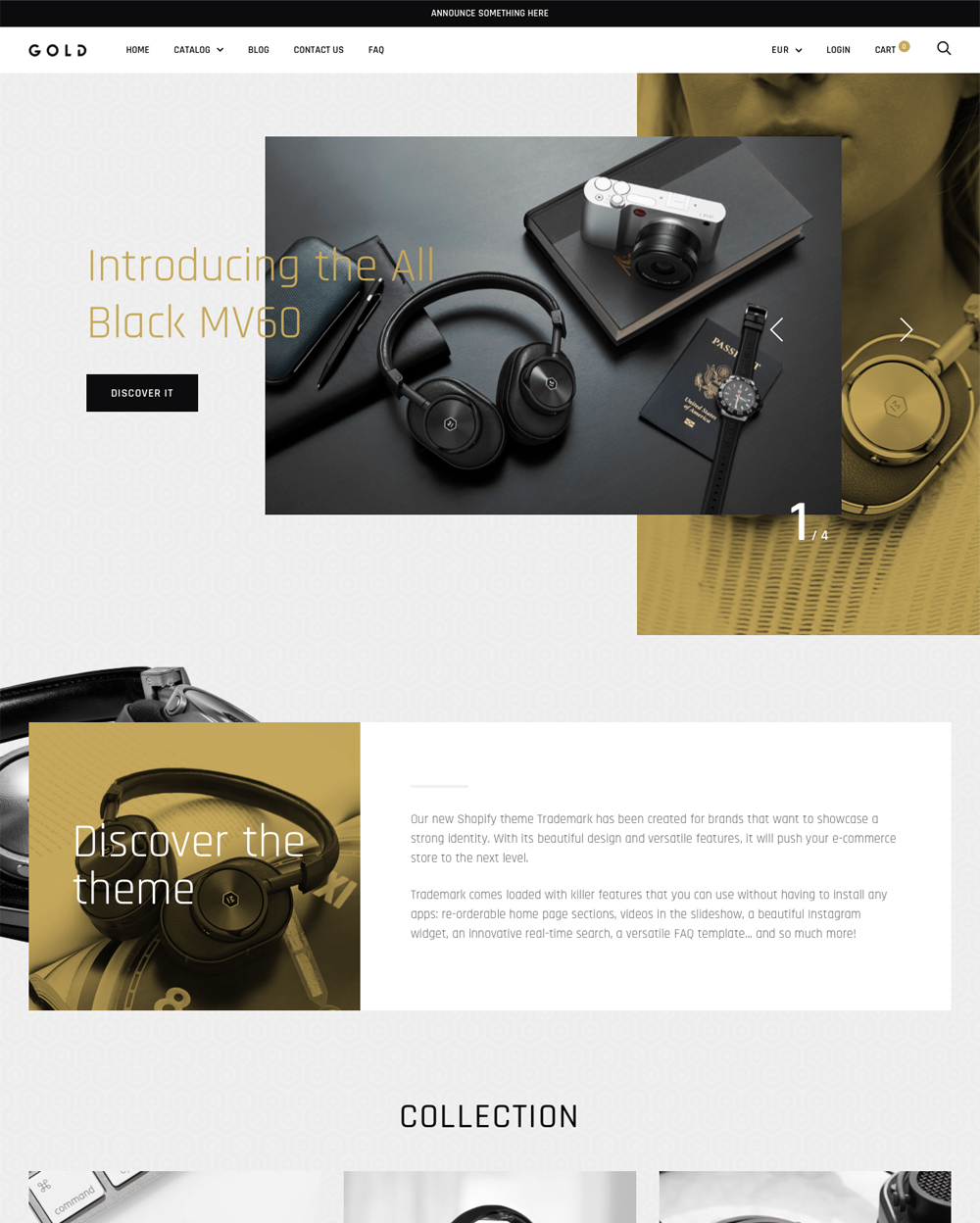

Trademark

|

|

| 10 |

|

Artisan

|

|

|

Show More

|

|||

What Does Passive Income Mean?

Passive income is a form of earning revenue where a limited amount of work is completed on a regular basis for the seller. For instance, you will have an item that you sell that doesn’t require any interaction between the seller and the buyer.

What Are Examples of Passive Income

There are numerous passive income examples that are available across the internet. For example, some of the available options include selling books/e-book, dropshipping, affiliate marketing, sponsorship and rental.

These kinds of passive income can be run just from your website, and you have limited other work to do. And the rewards can be very good for your revenue.

For example, the average affiliate marketing professional in the USA earns between $20,000 and $38,000 a year. Some of them can earn more than $100,000 a year.

Dropshipping businesses can also earn a lot of money.

Authors that sell e-books and print on demand books using apps like Lulu have found that selling 99 cent books have earned them more than $100,000 a year, too.

Therefore, there are lots of options.

Can You Mix Passive Income with Active Income?

Yes, you can mix passive income with an active income that you have. For instance, if you sell computer software, you can also add affiliate marketing options to your website enabling you to promote web hosting, computer systems and more that allow you to improve your income.

Passive income is a great way to earn more revenue without having to increase the number of hours that you have to work significantly. Therefore, you can build a stronger business where your income per hour is much higher.

Another example of adding passive income to your brand is when you have a marketing/management consulting business, and you write and sell a book.

Advantages of Passive Income

There are numerous advantages of passive income for business owners. For one, it takes very little time to manage the orders that are made from passive income. Even dropshipping often only requires you to press a button when you’re selling products through Oberlo or another dropshipping app.

Another advantage is cost. Costs are generally lower for passive income because the cost to deliver is often much lower with products that are already purchased or produced (like e-books).

Finally, there is the fact that you can reduce the number of hours that you have to work to earn revenue. In many cases, you can build revenue with only a small amount of hours of production needed.

Exploring Passive Income

Maximizing Passive Income Potential

To maximize passive income and enhance your financial standing, direct your attention towards scalable ventures. By concentrating on opportunities, you can unlock the substantial growth without necessitating additional.

Passive Income and Financial Freedom

The pursuit of passive income can pave the way to financial freedom, reshaping your financial landscape in several key ways. One of its primary advantages is the ability to establish a steady and consistent cash flow.

Building Passive Income Streams

It’s important to recognize that the creation of passive income streams necessitates an initial investment, whether time, money, or both. While this may seem daunting, it’s a phase in the journey towards passive income generation.

Maximizing Passive Income

Investment Strategies

When considering your investment options to generate passive income, learn more about the basics and strategies of passive income, then explore a diverse range of assets that can include dividend stocks, real estate holdings, or even the creation and sale of digital products.

Understanding Tax Implications

Passive income streams often come with specific tax treatments that are distinct from earned income. Have a solid understanding of these tax implications to maximize your earnings and ensure compliance with tax regulations.

Long-Term Financial Planning

Passive income plays a pivotal role in achieving financial independence. It represents the ability to earn income without the need for continuous active work or employment.

Conclusion: What Does Passive Income Mean?

Passive income is a simple way of earning money online by having some simple products/services that don’t require you to do much work to make it happen. There are numerous examples and opportunities available, including those mentioned earlier in the article.

-

How much time does it take to set up a passive income stream?

The time to set up a passive income stream can vary based on method and level of expertise. Some streams can be set up quickly, while others may take months or even years.

-

How can I identify a profitable niche for passive income?

Identifying a profitable niche for passive income involves a strategic approach that combines your interests and market opportunities. Start by considering your own passions, knowledge, and expertise.

-

What digital platforms are best for generating passive income?

Blogging through platforms like WordPress, Blogger, or Medium allows you to create content that can generate passive income through advertising, affiliate marketing, and sponsored posts.

PageFly Landing Page Builder

PageFly Landing Page Builder  Shopify

Shopify  SEMrush

SEMrush  Website Maintenance

Website Maintenance  UpPromote

UpPromote