Or go to our Shopify Theme Detector directly

What Is Non-Passive Income?

Last modified: March 13, 2024

Many people working for the first time in business might come across the idea of passive and non-passive income. However, what is non-passive income, and what is passive income? In this article, we look at the difference between these two different types of income and what the advantages are.

| # | Name | Image | |

|---|---|---|---|

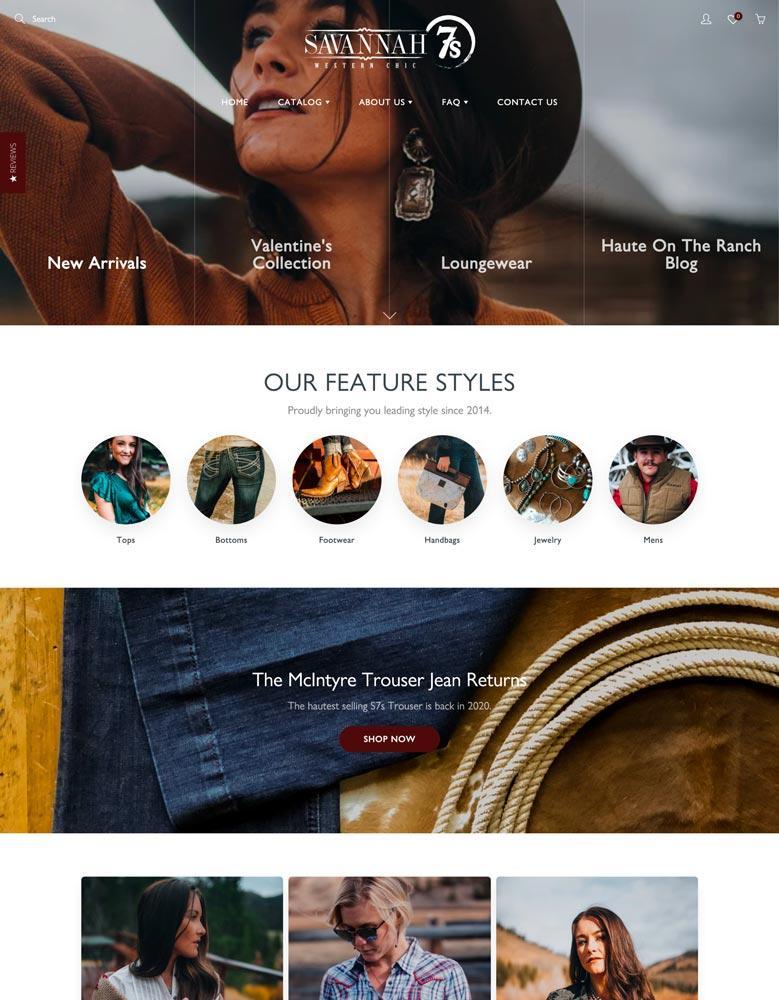

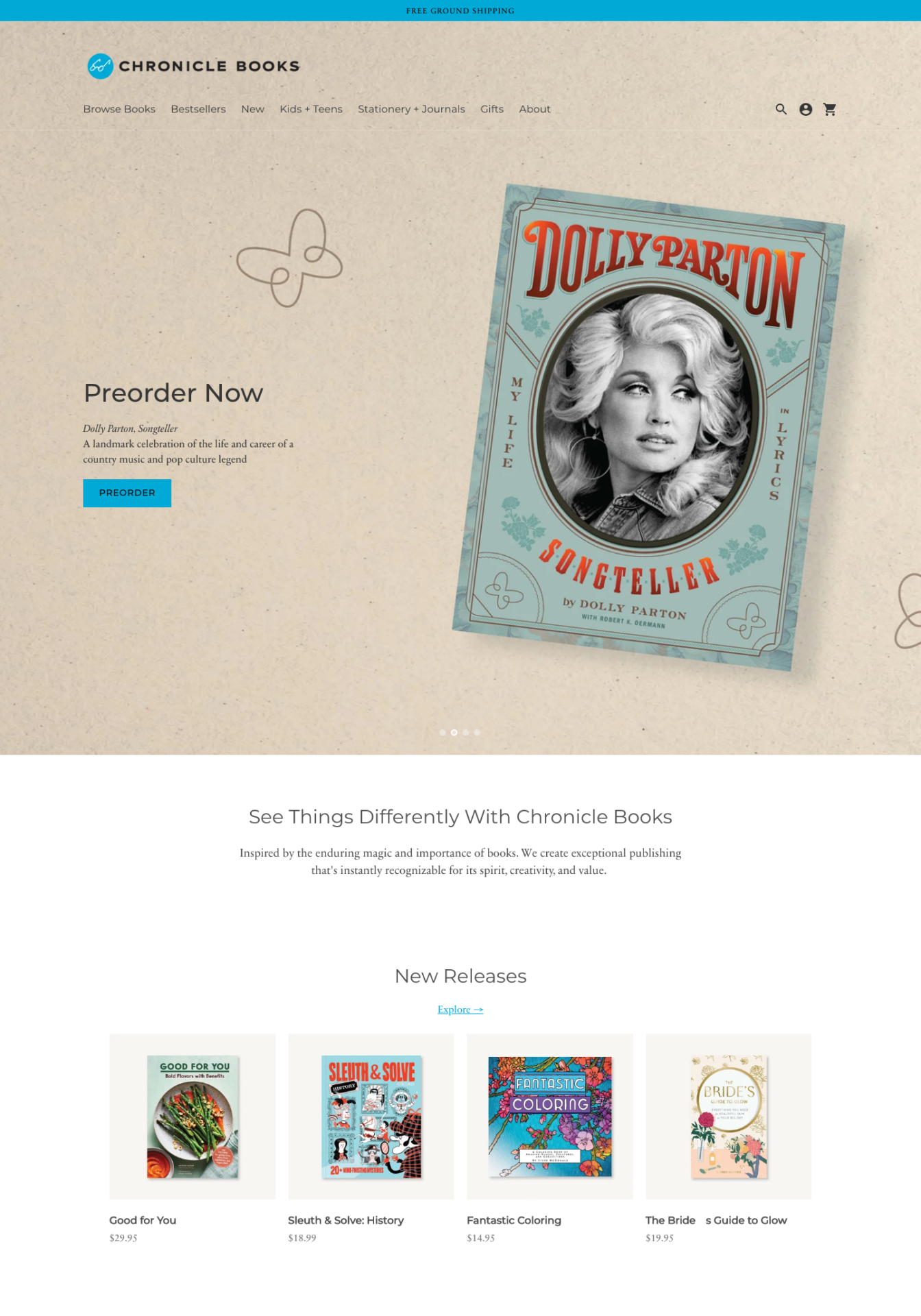

| 1 |

|

Galleria

|

|

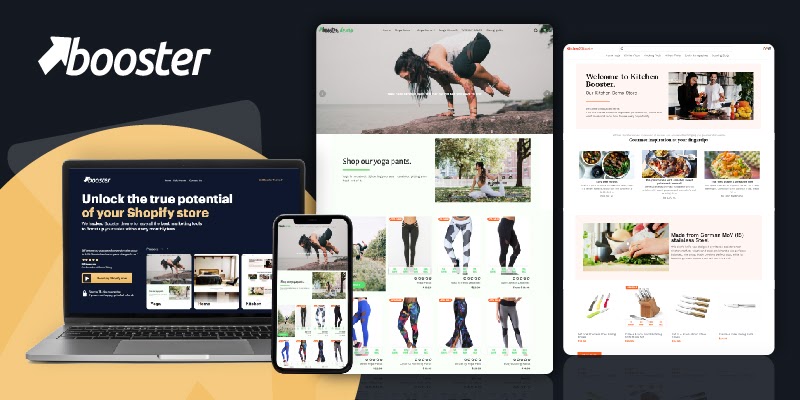

| 2 |

|

Booster

|

|

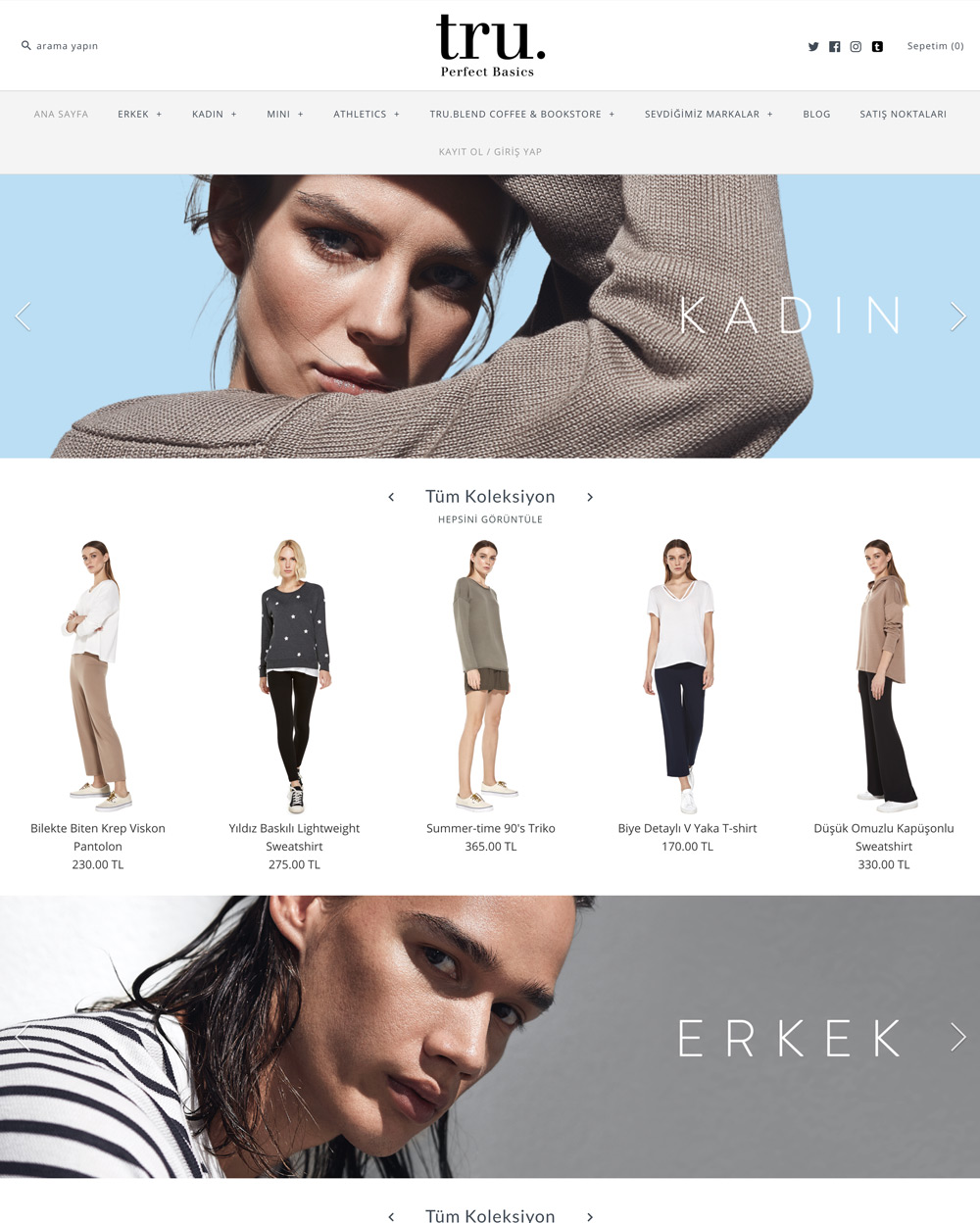

| 3 |

|

Symmetry

|

|

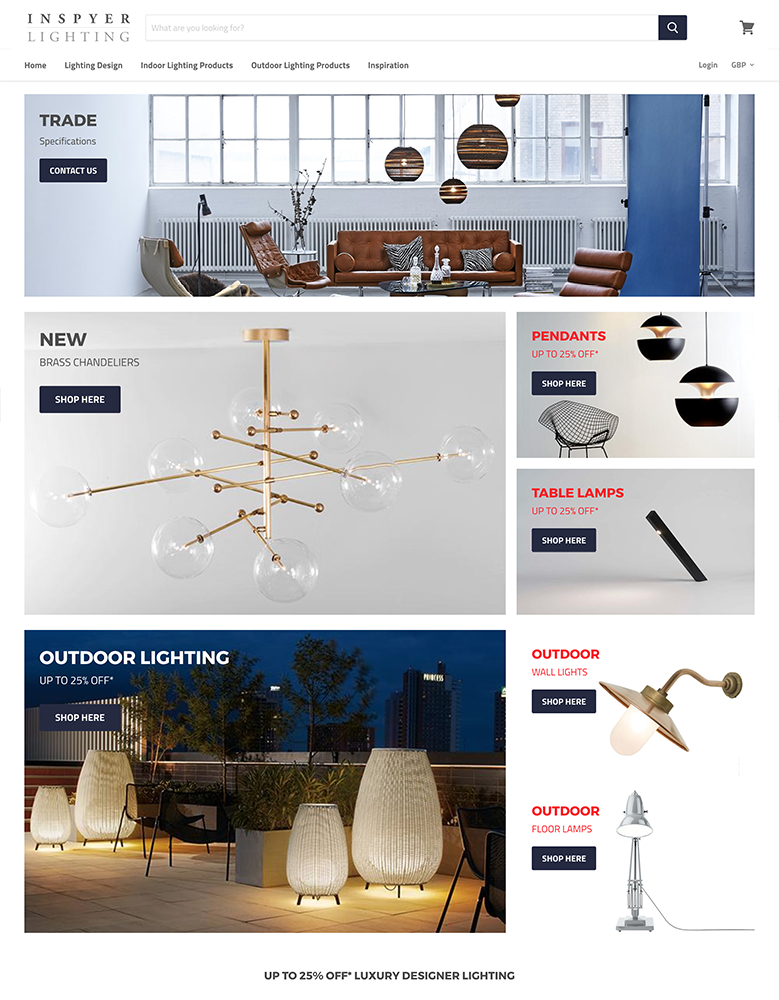

| 4 |

|

Empire

|

|

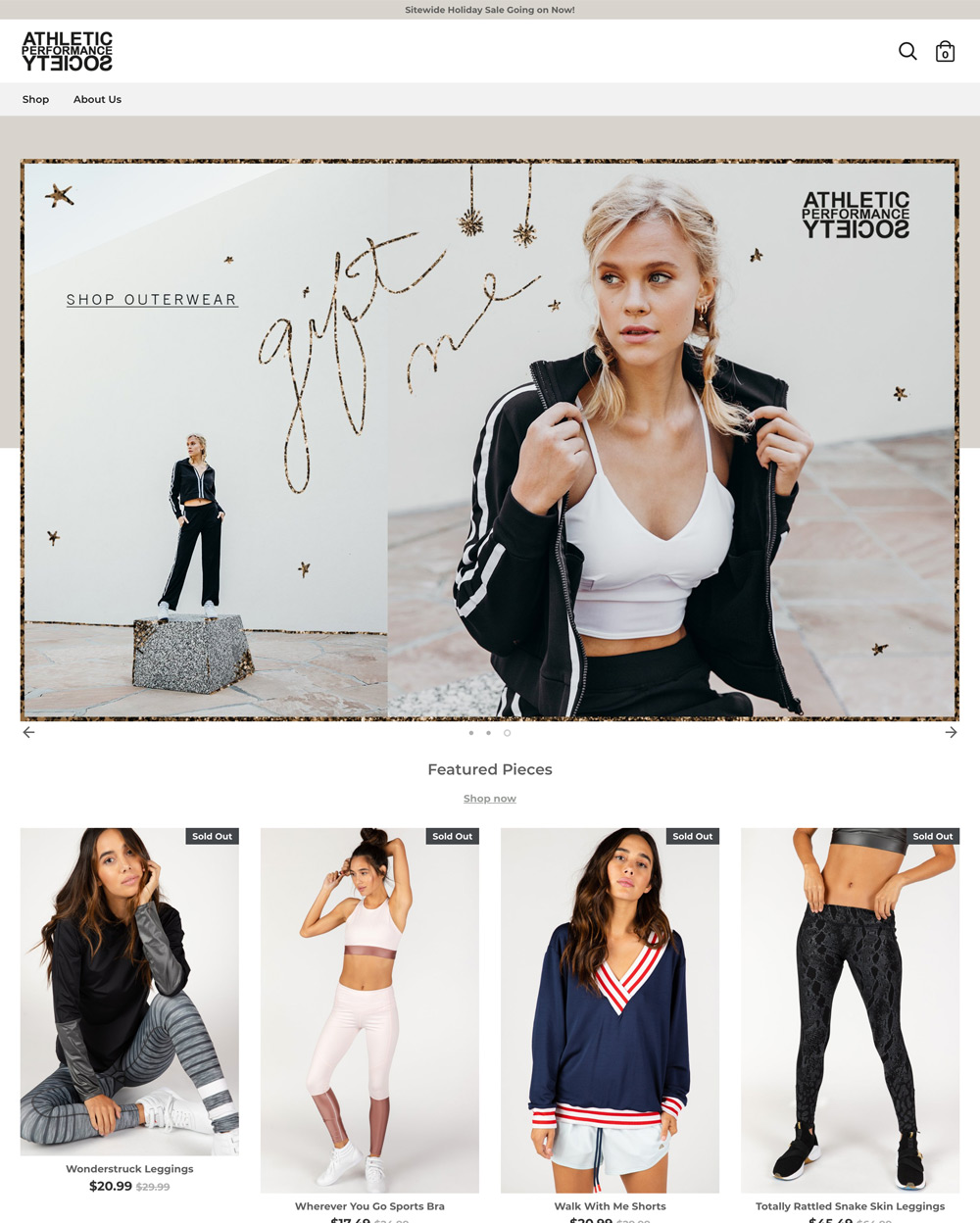

| 5 |

|

Avenue

|

|

| 6 |

|

Context

|

|

| 7 |

|

Boost

|

|

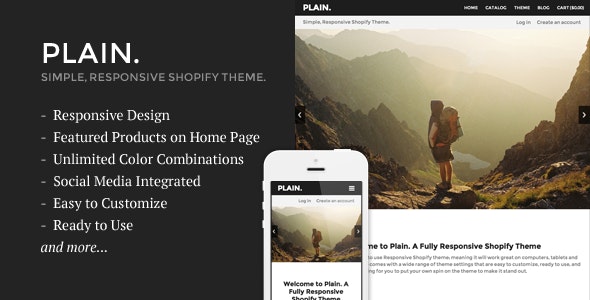

| 8 |

|

Plain

|

|

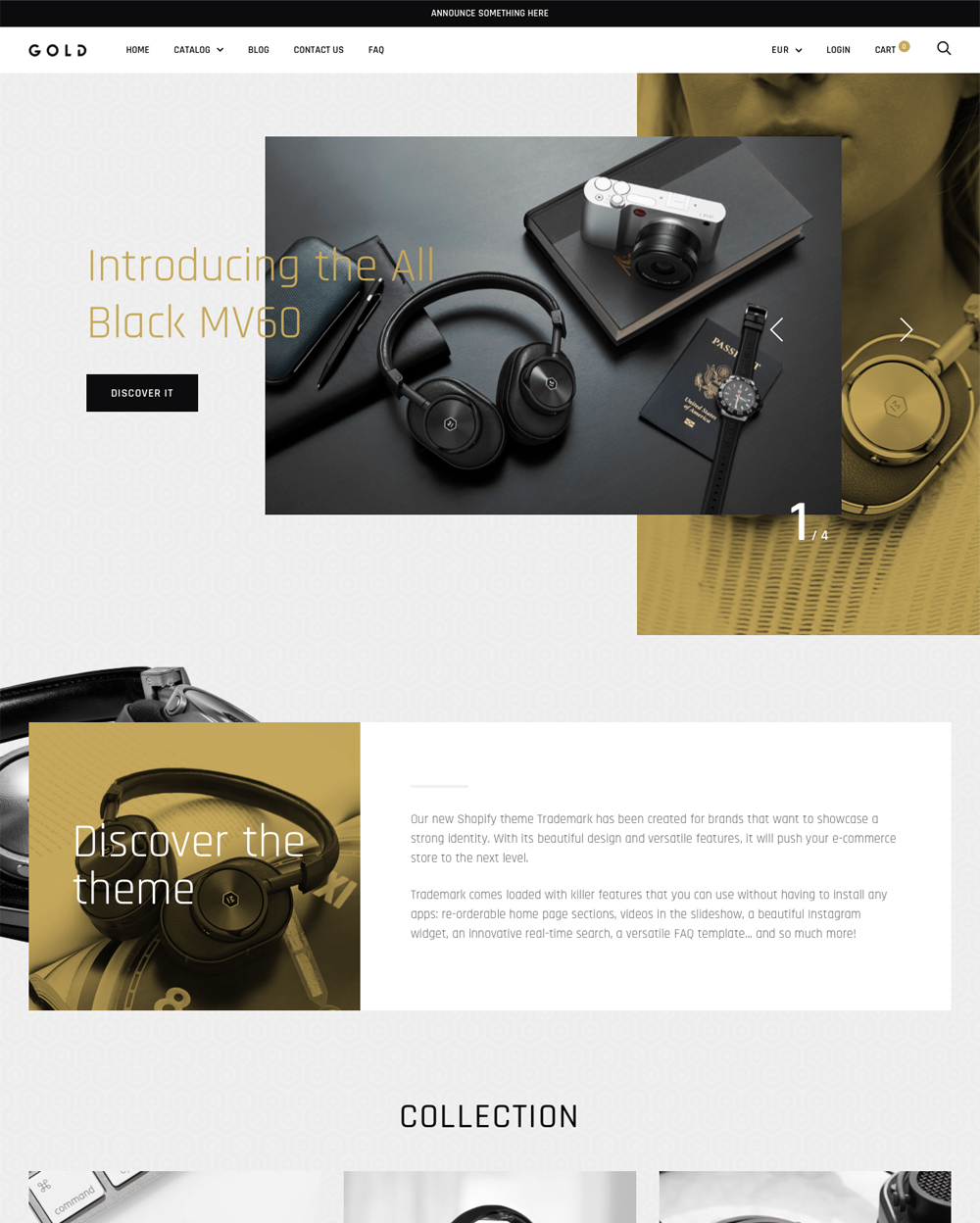

| 9 |

|

Trademark

|

|

| 10 |

|

Artisan

|

|

|

Show More

|

|||

What Is Non-Passive Income?

Non-passive income is revenue that is generated by a business where they agree to provide a service/product to the customer that they have to do something with. Most businesses tend to operate with non-passive income, and very few tend to have passive income.

For instance, most service businesses like accountants, hairstylists, decorators, etc. can be considered to be non-passive income businesses.

So can those that are selling products traditionally like sportswear, clothing, toys, etc. As long as there is stock within the business or the employees/owners of the business have to do a considerable amount of work to fulfil the order, then the order is non-passive income.

What Is Passive Income?

Passive income is when the business produces a product/service/feature that earns revenue without any significant effort of the seller to fulfil the order. There are numerous examples of passive income such as selling e-books, dropshipping and affiliate marketing.

That doesn’t mean that the seller doesn’t do any work. There is a lot of work to be done in the marketing and maintenance of the business. However, after a sale is made, there is little interaction between the buyer and the seller.

What Income Strategy Is Best?

Before we go further, learn the passive income basics and strategies. While many would argue that one strategy of income is better than another, the truth is that there is no solid answer. For example, passive income has its advantages, but there is little room to interact with the customer and this can have a detrimental impact on the success of customer retention.

However, passive income can be much more rewarding with fewer hours worked for higher levels of income.

There are problems/advantages of the different business models. For example, those who are dropshipping or affiliate marketing may have quality control issues. In contrast, those that are selling products traditionally might have supply issues.

What is generally accepted as the best practice is a mixture of both passive and non-passive income. This allows you to build a stronger business model that can often mean that no matter the current economic concerns within a business, there is always going to be some form of revenue being generated.

Understanding Non-Passive Income

Types of Non-Passive Income

Non-passive income, also known as active income, includes earnings from direct involvement in a business or job. This encompasses wages, salaries, tips, bonuses, and commissions.

It’s the income you actively work for, whether through employment or running a business.

Tax Implications

Non-passive income is distinct from passive income in tax treatment. It’s declarable in the year earned and cannot be offset with passive losses. Understanding these tax implications is crucial for accurate financial planning and reporting.

Active Participation Requirements

The IRS defines non-passive income based on active participation. For instance, involvement in a business venture for over 500 hours annually qualifies as non-passive. This criterion ensures that the income is a result of substantial, direct effort.

Strategic Financial Planning for Non-Passive Income

Investment and Retirement Income

Investment income, including dividends and interest, can be non-passive, depending on your level of involvement. Retirement income, such as pensions and Social Security, also falls under non-passive income, reflecting your past work contributions.

Losses and Deductions

Non-passive losses, incurred in active business management, can offset other income types, reducing overall tax liability. However, meeting the IRS criteria for material participation is essential to qualify for these deductions.

Income Management Strategies

Balancing non-passive and passive income sources is key to a robust financial strategy. This balance helps in managing tax liabilities and ensuring a steady income stream, crucial for long-term financial stability and growth.

Conclusion: What Is Non-Passive Income?

What is non-passive income? It is revenue generated with the seller has to perform a significant amount of work to fulfil the order. There are advantages of using non-passive income models alongside passive income to ensure that there are always good business opportunities within the business. Shopify is a great platform for both passive and non-passive income.

-

Can investment income be considered non-passive?

Investment income can be non-passive if it involves active participation, like managing a portfolio or trading stocks frequently. However, most investment income, such as dividends or interest, is typically considered passive.

-

Are bonuses and commissions considered non-passive income?

Yes, bonuses and commissions are considered non-passive income as they are typically earned through active employment or personal business efforts. They require direct involvement to be earned.

-

Does owning a business automatically make the income non-passive?

Not necessarily. Business income is non-passive only if you are materially involved in its operations. Merely owning a business without active involvement would not classify the income as non-passive.

PageFly Landing Page Builder

PageFly Landing Page Builder  Shopify

Shopify  SEMrush

SEMrush  Website Maintenance

Website Maintenance  UpPromote

UpPromote