Or go to our Shopify Theme Detector directly

Are Royalties Considered Passive Income?

Last modified: March 13, 2024

What are royalties? What are the benefits of royalties and are royalties considered passive income? These are three excellent questions that we will be looking into and answering in this article.

| # | Name | Image | |

|---|---|---|---|

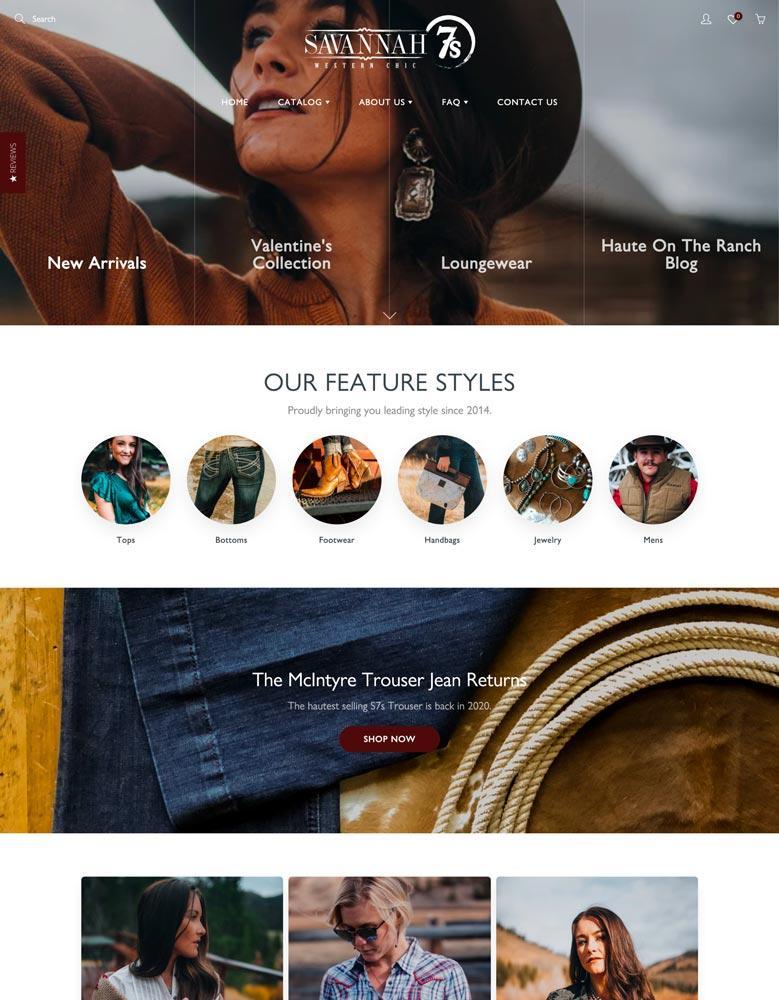

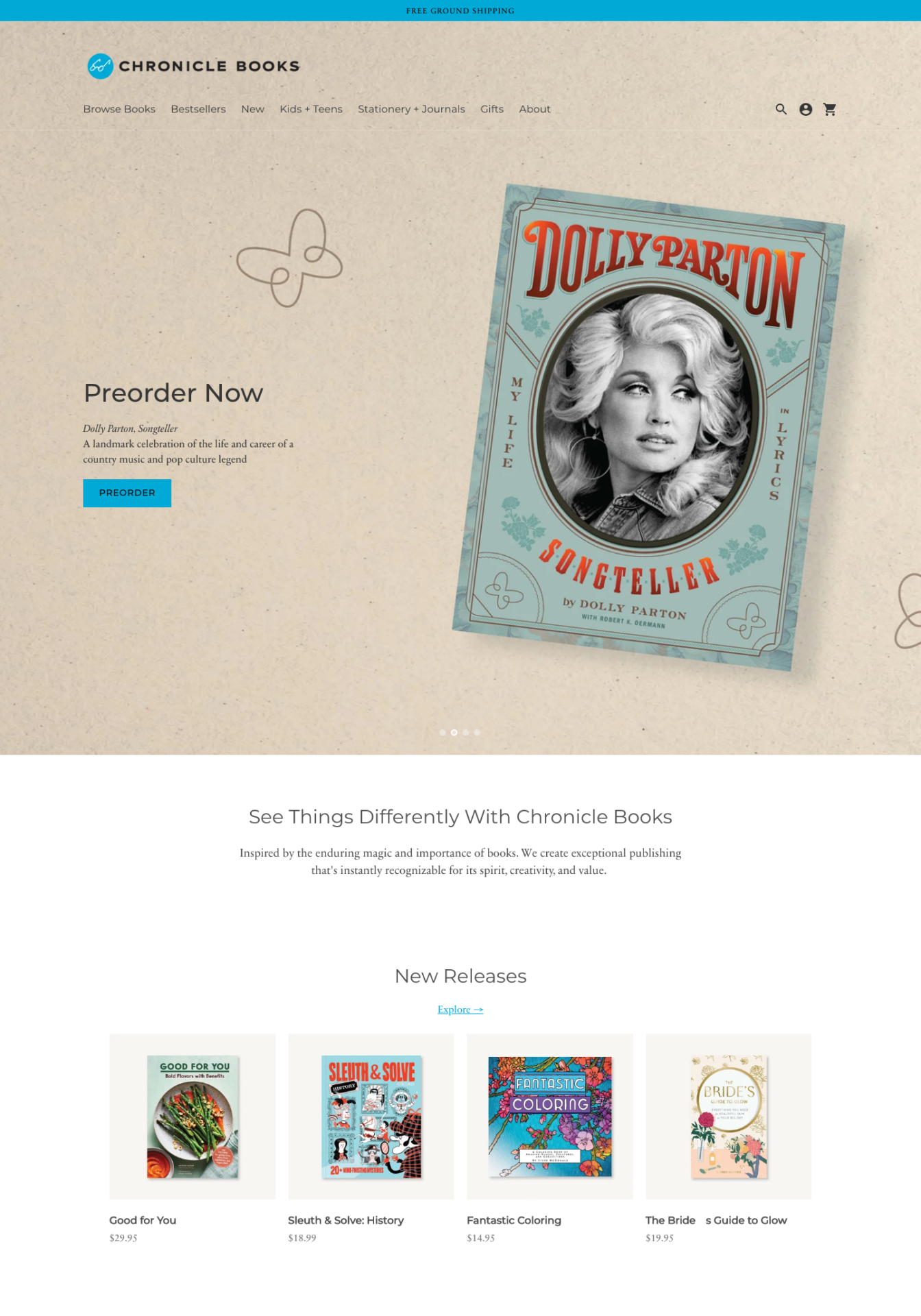

| 1 |

|

Galleria

|

|

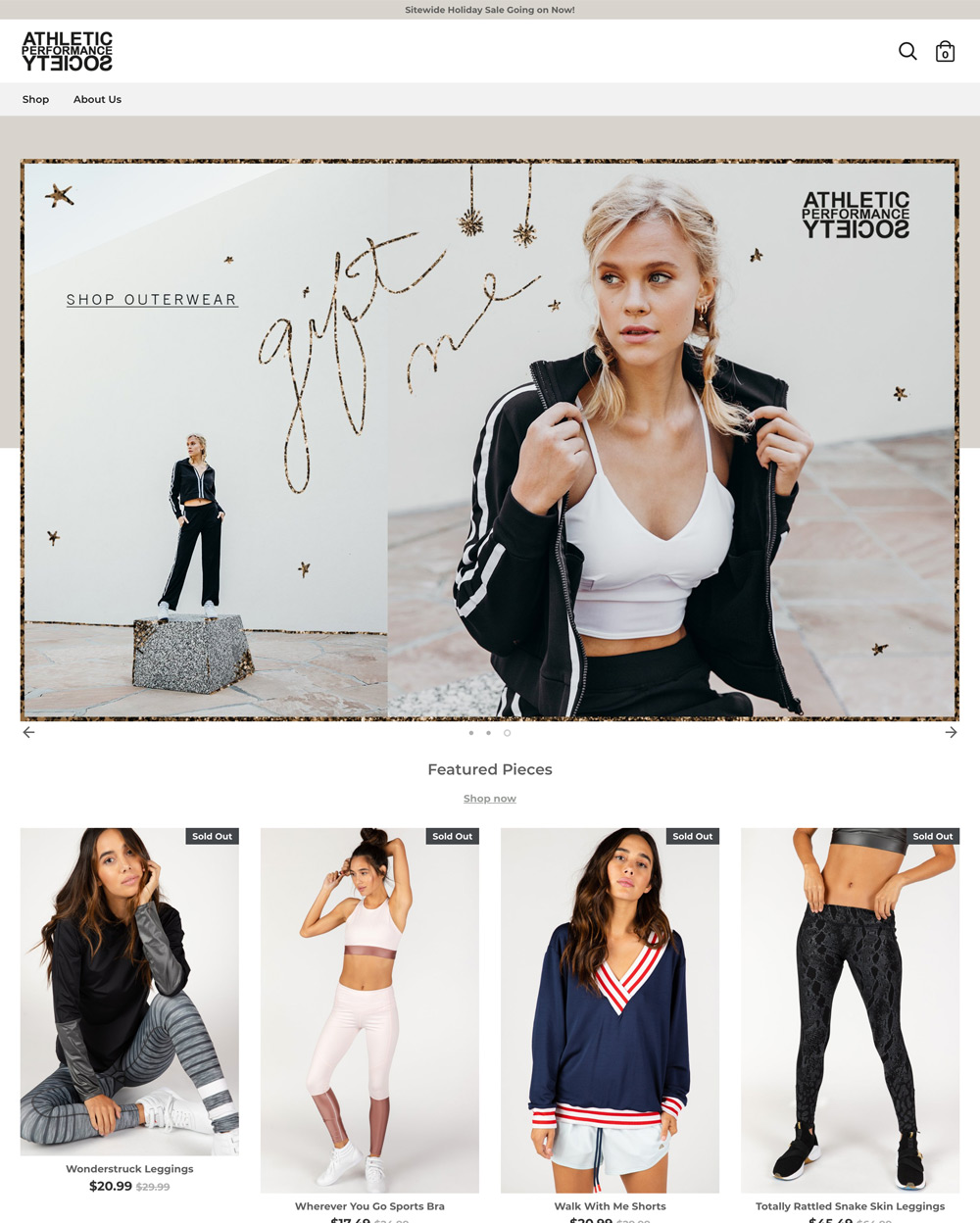

| 2 |

|

Booster

|

|

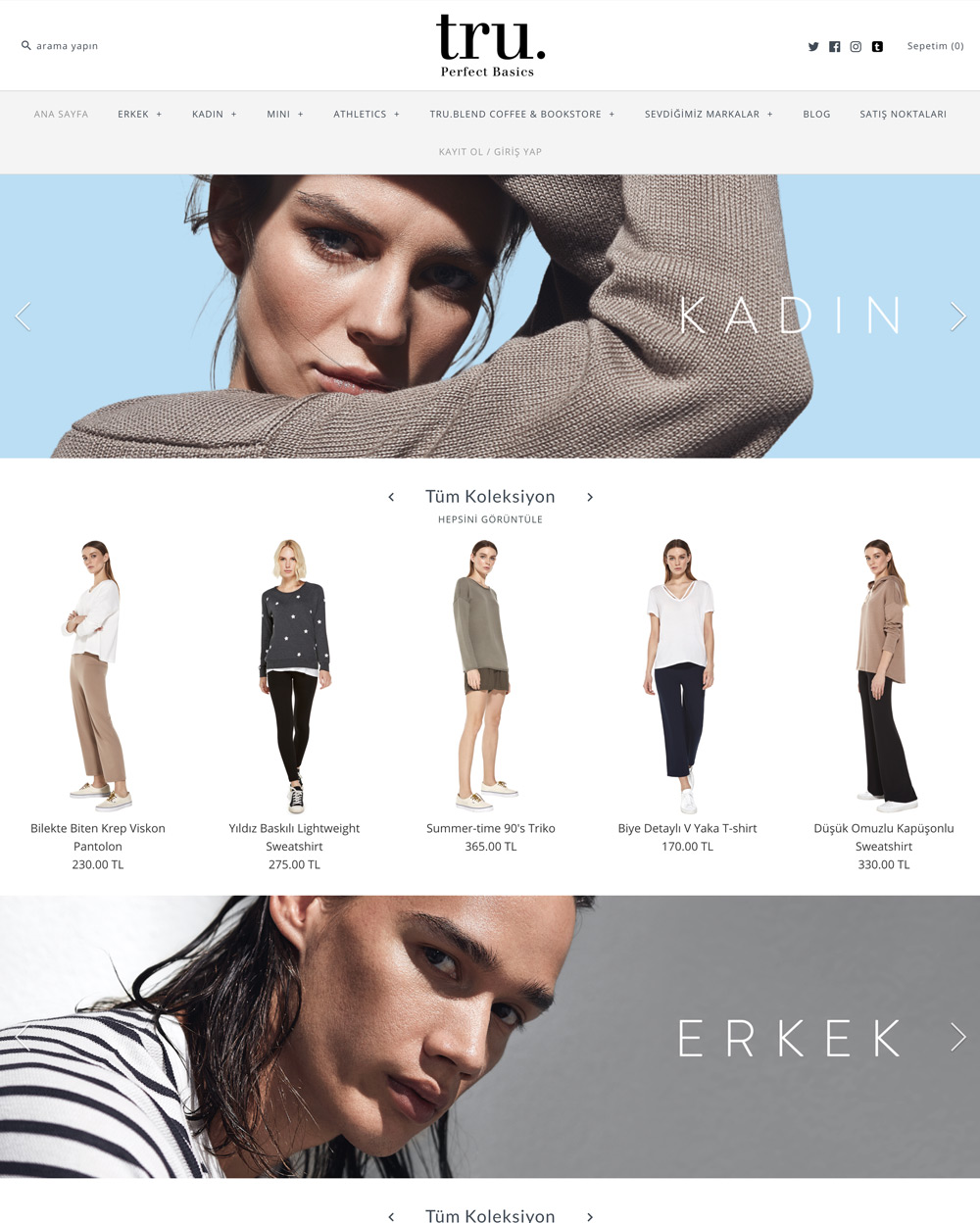

| 3 |

|

Symmetry

|

|

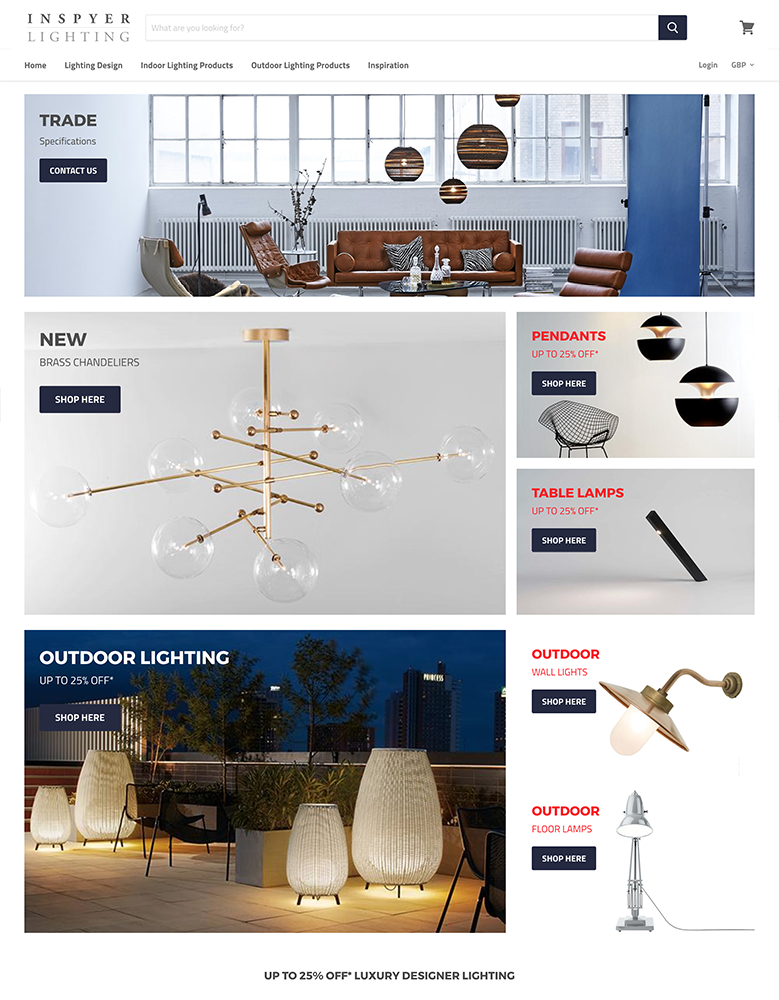

| 4 |

|

Empire

|

|

| 5 |

|

Avenue

|

|

| 6 |

|

Context

|

|

| 7 |

|

Boost

|

|

| 8 |

|

Plain

|

|

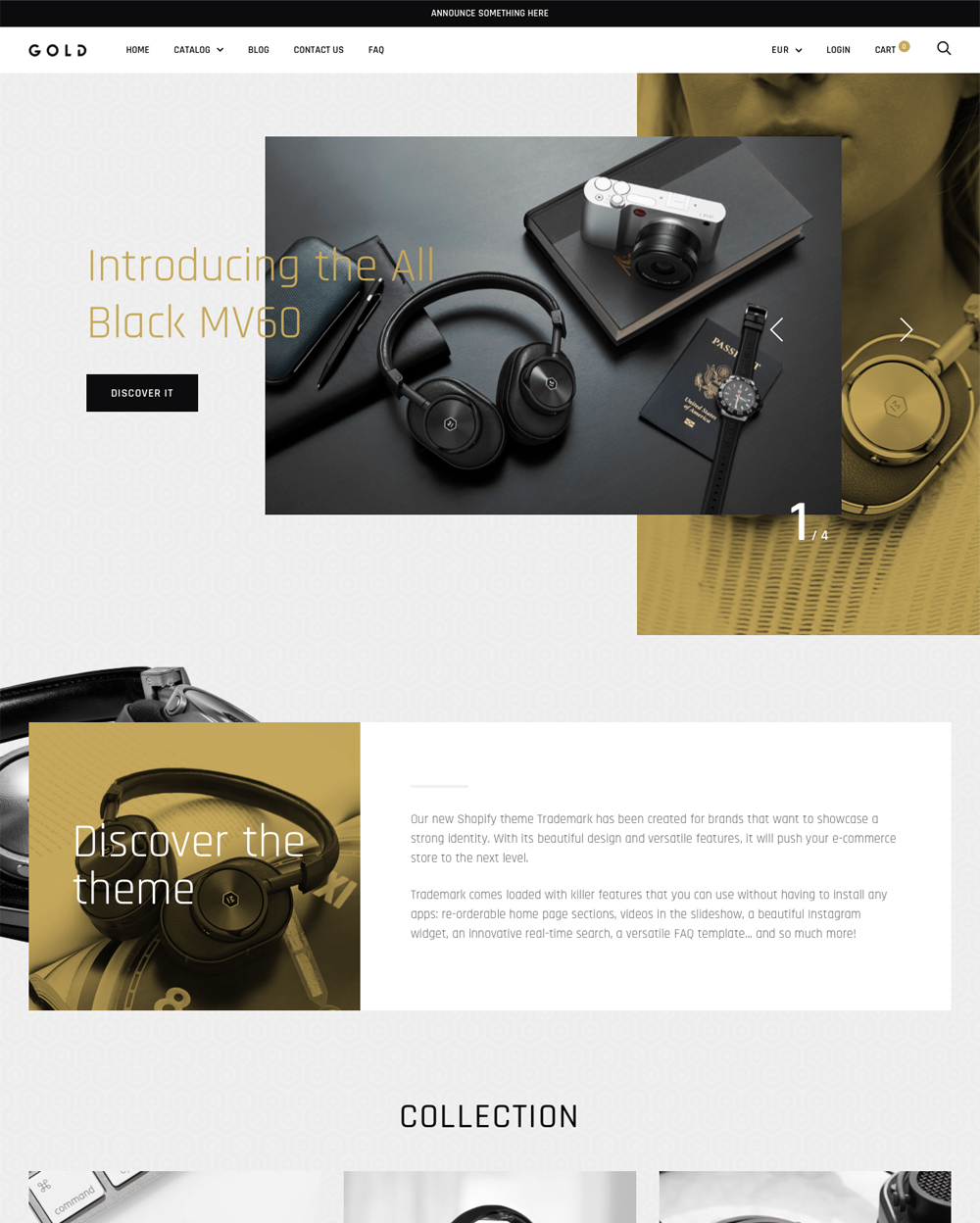

| 9 |

|

Trademark

|

|

| 10 |

|

Artisan

|

|

|

Show More

|

|||

What Are Royalties?

Royalties are payments that are a legal requirement to an individual for the ongoing use of an asset. The asset can be anything from a copyrighted work, franchise or natural resources. Royalties are used across the digital world, from small musical pieces that are used on YouTube videos or in podcasts, to images used on blog posts and more.

The idea of royalties is that it is a way for the artist or owner of the asset to be compensated for the work that they’ve previously done by those who want to use it.

Advantages of Royalties

The idea of royalties is that an asset owner can create one piece of content, like music or images, and this can then be used across numerous other articles/assets in whole or in part. However, the original creator is compensated for their work.

The person using the asset can expect the royalties to be a lot cheaper than if they were commissioned for original work to be completed. And the artists can expect regular, but smaller pieces of work to be created.

When you’re using a website platform, like Shopify, you can build a strong library of assets that can be sold to users for use in their projects. You can determine the license agreement too. For instance, you can state that the customer can only use the asset for so long or on so many projects.

What Digital Products Could Be Considered Available for Royalty Payments?

Numerous products could be considered royalty products. These include:

- Photographs

- Artwork

- Music

- Sound effects

- Gifs

- Stock videos

- Website coding

- Software coding

Other assets might be considered for royalties as well. And these can all be sold on Shopify.

Are Royalties Considered Passive Income?

Royalties are passive income because once the initial asset has been created, there is generally very little work that needs to be done. This makes them an excellent investment opportunity.

One of the things that’s not a passive income, but sometimes considered as one by the market, is NFTs. These are small pieces of digital artwork owned by one person. The reason these are not passive income is that the artist needs to create unique pieces for each sale.

If there was more than one version, their value would be a lot lower, and they wouldn’t be technically counted as an NFT.

Investing in Royalties as Passive Income

Royalty Income as an Investment

Royalties offer a unique investment opportunity, providing a potential source of steady, long-term income. This form of income is often insulated from market fluctuations, making it an attractive option for diversifying investment portfolios.

Types of Royalties for Investment

Investors can explore various types of royalties, such as those from oil and gas, minerals, patents, and intellectual property like music and books. Each type offers distinct advantages and opportunities for income generation.

Methods of Investing in Royalties

Investing in royalties can be done through purchasing shares in royalty trusts or participating in royalty auctions. These methods allow investors to earn income from a range of assets without the need for direct ownership or management.

Understanding Royalty Taxes and Passive Income

Tax Implications of Royalty Income

Royalty income is typically taxed at capital gains rates, which are generally lower than regular income tax rates. This favorable tax treatment adds to the appeal of royalties as a passive income source.

Managing Royalties in Investment Portfolios

Including royalties in an investment portfolio can provide balance and stability. However, it’s essential to understand the potential risks and rewards, and consider consulting with a financial advisor for tailored advice.

Royalty Trusts and Tax Benefits

Investing in royalty trusts offers a straightforward way to gain exposure to royalties. These trusts often distribute a significant portion of their income as dividends, providing tax advantages to investors.

As you navigate the complexities of investing in royalties for passive income, it’s crucial to ground your strategy in a solid understanding of the basics and strategies of passive income.

Conclusion: Are Royalties Considered Passive Income?

When it comes to earning online, there are lots of options. Passive income is an excellent option as it allows you to create a product and then sell the product again and again without having to do any more work. Selling royalties to certain assets is one passive income you can use.

-

What is the typical duration for receiving royalty payments?

The duration for receiving royalty payments varies based on the type of asset and the terms of the agreement. Payments can last for several years, or even a lifetime, depending on the asset’s continued use or production.

-

What is the impact of technological changes on royalty income?

Technological changes can significantly impact royalty income, either positively or negatively. For example, streaming services have transformed how music royalties are earned and calculated.

-

How do royalty payments fluctuate over time?

Royalty payments can fluctuate based on the performance and popularity of the underlying asset. For example, royalties from a hit song may decrease over time as it becomes less popular.

PageFly Landing Page Builder

PageFly Landing Page Builder  Shopify

Shopify  SEMrush

SEMrush  Website Maintenance

Website Maintenance  UpPromote

UpPromote